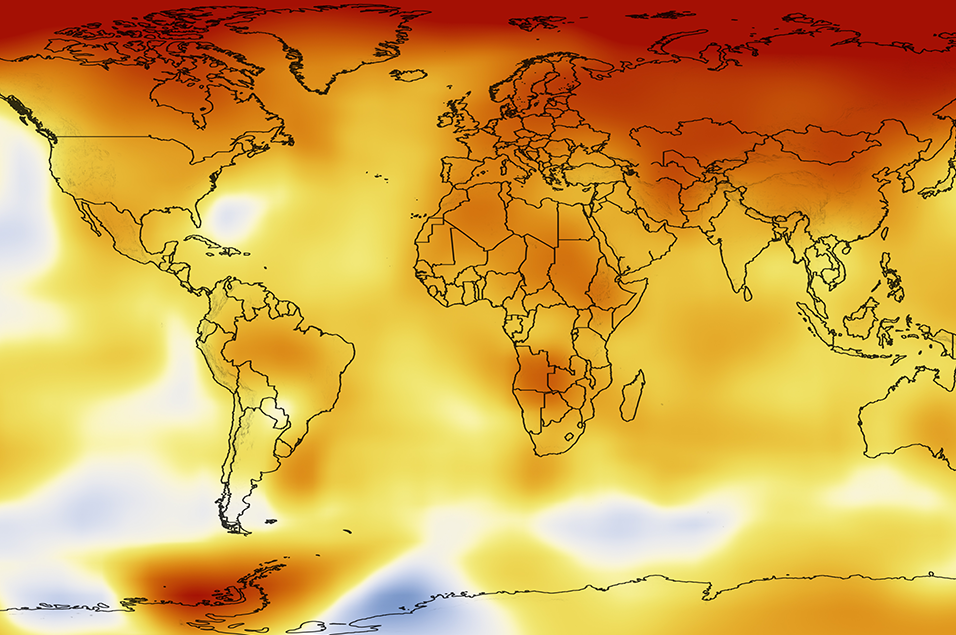

If America and Americans want to contain the influence of Iran, improve the health of our economy, and retard growth in global warming, we have at hand a silver bullet that can simultaneously accomplish all three: reduce fuel consumption, particularly gasoline. With a few minor adjustments to our driving habits, we can put more pressure on the Iranian government than another aircraft carrier battle group, we can reduce our burgeoning trade deficit and the upward pressure it exerts on interest rates, and we can turn the corner on reducing greenhouse gas emissions.

ENERGY PARADIGM SHIFT ESSENTIAL

While most Americans struggle with high gas prices at the pump, and worry about what it will cost to heat their homes this winter, America seems to be going nowhere fast in addressing its energy problems. Unfortunately, a number of political leaders are advocating increasing refining capacity, giving out billions in home heating subsidies and creating a mileage tax. While these solutions may seem helpful, they’re headed in the wrong direction because they focus on maintaining consumption or constraining transportation. A paradigm shift which focuses on significantly incentifying the conservation of energy is essential to addressing America’s energy, economic and environmental challenges. Incrementally increasing energy supplies, while generally helpful, will be consumed by our growing economy and will not reduce America’s massive oil import needs. If Washington, as well as the states, would raise taxes on energy, particularly gasoline, and offset that with a decrease in individual and corporate income taxes, Americans would be no worse off in terms of total taxes, but we would all have a strong incentive to further reduce energy consumption. Our tradition in America of taxing income in effect restrains growth. What we really need to restrain is the consumption of energy which significantly contributes to pollution, global warming, and our nation’s growing trade deficit. Clearly, if ever there were an example of an appropriate use of tax policy to promote national goals, increasing taxes on energy consumption would be it.

REDUCE AMERICA’S OIL DEPENDENCE NOW

While our leaders in Washington seem to believe there’s little they can do to reduce America’s dependence on foreign oil in the short term, there are in fact a number of things they can do, but it will require some creativity and a healthy dose of political courage.

TAX OIL, NOT WORK

While our leaders in Washington seem to believe there’s little they can do to reduce America’s dependence on foreign oil in the short term, there are in fact a number of things they can do, but it will require some creativity and a healthy dose of political courage. For example, if the President Bush and Congress would raise taxes on gasoline, and offset that tax increase with a decrease in income taxes, American’s would be no worse off in terms of their total tax bills, but we would have some pretty strong incentive to reduce our consumption of fuel. If those taxes were scheduled to gradually increase every year, perhaps by 5% per year, while also reducing income taxes by an equivalent amount, Americans and American businesses would have the incentive and a vision for their need to reduce fuel and energy consumption. Our leaders in Washington suggest that technology and increasing domestic supplies of energy are the key to energy independence. However, real reductions in America’s energy dependency, as well, as reducing pollution and global warming, are tied to reducing our consumption of energy, particularly fuel for cars and trucks.